Is Pepsi a Good Investment Stock?

The global food, snack, and beverage company PepsiCo, Inc. has its headquarters located in Harrison, New York. Originally established as the “Pepsi-Cola Company” in 1898, the firm changed its name to “PepsiCo” in 1965 to reflect its expansion into the food sector. The New York Shares Exchange (NYSE) uses PEP as the symbol for PepsiCo’s shares.so quickly and fast let’s dive into this Pepsi Investment stock.

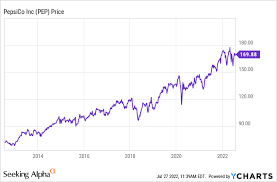

Return on Investment for Pepsi

The return on investment (ROI) for Pepsi depends on various factors such as the initial investment amount, the current market price of Pepsi’s stock, and future dividends and capital gains. As of March 2023, Pepsi’s annual dividend per share is $1.44, and its current market price is around $150. Assuming an investor purchases 100 shares at this price, their initial investment would be $15,000. If they hold these shares for a year and receive the annual dividend payment, their total return would be:

Total Return = (Dividend Payment) + (Capital Gain or Loss) Total Return = ($1,440) + ($[Change in Market Price] * 100 shares)

How to Calculate ROI accurately?

To calculate the ROI accurately, one would need to know the change in market price over the investment period. For example, if the market price increases by $5 per share over the year, then:

Total Return = ($1,440) + ($5 100 shares) = $3,490 ROI = [(Total Return – Initial Investment) / Initial Investment] 100% ROI = [($3,490 – $15,000) / $15,000] * 100% ≈ -56.6%

This calculation shows a negative ROI due to the large initial investment compared to the total return. However, it’s important to note that investing involves risks and uncertainties; past performance does not guarantee future results. Moreover, holding stocks for longer periods can yield better returns as companies grow and increase their dividends over time. To get a more accurate estimate of potential ROI for investing in Pepsi or any other stock, consider using financial calculators or consulting with financial advisors.

Is the Pepsi Investment Legit?

Yes, investing in Pepsi through recognized stock exchanges like NYSE is considered a legitimate investment opportunity. However, it’s essential to conduct thorough research before making any investment decisions to understand the potential risks and rewards associated with purchasing Pepsi stock. Factors such as financial statements analysis (e.g., revenue growth rate), industry trends (e.g., consumer preferences), competitive landscape (e.g., Coca-Cola competition), and macroeconomic conditions should be considered before deciding whether or not to invest in Pepsi or any other company’s stock. Additionally, always ensure that you are dealing with reputable brokers when buying or selling stocks through online platforms or traditional brokerage firms to minimize potential fraud risks.

Can I Invest in Pepsi?

Yes! Anyone who meets specific eligibility requirements can invest in Pepsi by purchasing its stocks through recognized stock exchanges like NYSE or through various online brokerages such as E*TRADE Securities LLC or Charles Schwab Corporation. To begin investing in stocks like PepsiCo Inc., follow these steps:

- Open a brokerage account;

- Add money to your account;

- Look up firms you want to invest in;

- Place an order to purchase shares of those companies; and

- Keep a close eye on your investments.

Make well-informed judgments about purchasing or disposing of them according to your financial objectives and the state of the market. Remember that there are risks and uncertainties associated with investing; previous success does not guarantee future results! You must conduct thorough research before making any investing selections!

Should You Invest in Coke or Pepsi?

Both Coca-Cola (KO on NYSE) and PepsiCo have strong brand recognition and stable financial performances within their respective industries – soft drinks/beverages and snack foods/food services sectors – making them attractive options for investors seeking long-term growth opportunities with solid dividends from established companies.

When deciding between investing in Coke vs Pepsico stocks:

Take into account elements like the competitive advantages of each company.

- Product offerings: expansion tactics,

- Acquisitions: monetary stability,

- Rates of revenue growth: market patterns

- Macroeconomic factors (economic stability) that influence consumer choices

- Individual risk tolerance levels

Before making a well-informed decision based on your goals and aspirations regarding money!

Both businesses have a record of success, but your particular investing approach may make them more or less appealing! In the end, it all boils down to comprehending the distinct advantages and disadvantages that each business has inside its particular sector!

Is it worthwhile to invest directly in Coca-Cola? Absolutely! Because of its well-known brand and steady financial performance over many years, Coca-Cola is regarded as a reliable long-term investment choice for investors looking for reliable returns from well-established beverage sector firms! But keep in mind that there are dangers and uncertainties associated with investing of any kind, so before making any judgments, such as “Is Pepsi a Good Investment stock or Coke?” consider all the relevant factors, including the state of the market and your financial objectives!