Investment Opportunities in Ghana

Ghana, a country in West Africa, has gained popularity with international investors as a result of its better economic statistics. Stable political climate and a wealth of natural resources. The nation appeals to investors. Wish to grow into the African market or diversify their portfolios since it provides a wide range of investment options across many industries. Without delay, let’s dive into investment opportunities in Ghana.

Economic Overview and Stability

Ghana’s economy has shown resilience and progress in recent years, with the World Bank naming it the best-performing economy in West Africa in 2020. The country has demonstrated stability through its democratic governance system and commitment to multi-party politics. President Akufo-Addo’s administration has focused on debt sustainability improvements and implementing reforms to attract private sector investments.

Key Sectors for Investment

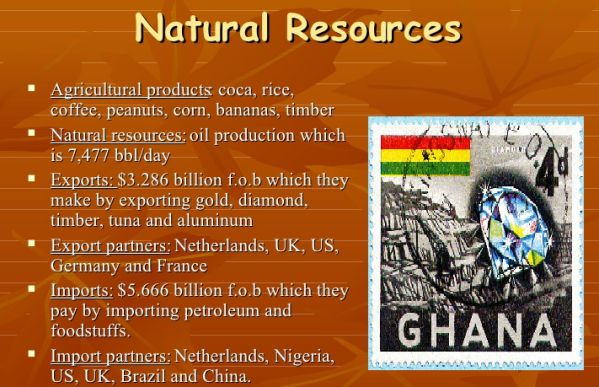

Natural Resources:

Ghana is the second-largest cocoa producer globally. A significant gold miner, and holds the title of the fastest-growing economy in the region. The country also boasts substantial reserves of bauxite, iron ore, manganese, and oil and gas. These resources present lucrative opportunities for investors interested in mining, energy exploration, and related industries.

Infrastructure Development:

Ghana’s infrastructure sector offers promising investment prospects. Particularly in transportation networks like roads, ports (such as Tema Port), and airports (notably Kotoka International Airport). With a growing population and increasing trade activities within the African Continental Free Trade Area (AfCFTA). There is a demand for modernized infrastructure to support economic growth.

Financial Services:

The financial sector in Ghana is evolving rapidly, driven by advancements in digitalization and regulatory reforms. Opportunities exist for investments in banking services, insurance products, fintech innovations, and microfinance institutions catering to underserved populations.

Manufacturing and Agribusiness:

Ghana’s strategic location within the AfCFTA makes it an ideal hub for manufacturing activities targeting regional markets. The agribusiness sector benefits from the country’s agricultural resources and export potential. Offering avenues for investment in food processing, packaging, and distribution.

Renewable Energy:

As part of its attempts to diversify its energy mix and promote sustainability, Ghana has actively sought investments in renewable energy projects such as solar farms, wind turbines, and hydropower plants. The government’s emphasis on clean energy creates chances for investors interested in green technology.

Incentives for Investors

The Ghanaian government has implemented various policies to attract foreign investments and support business growth:

- The Companies Act of 2019 regulates the incorporation of companies and upholds corporate governance standards.

- The Ghana Investment Promotion Centre (GIPC) Act of 2013 provides an incentive framework that promotes transparency and facilitates a conducive environment for investors.

- The GIPC serves as a liaison between government departments and investors, offering information on incentives, support services, networking opportunities, and business facilitation.

Last lines

For this, Ghana stands out as a promising destination for investment opportunities across multiple sectors due to its stable political climate, diverse natural resources, improved economic indicators, strategic location within Africa’s trade networks, and supportive government policies aimed at attracting foreign capital. By leveraging these opportunities effectively while navigating potential risks associated with debt sustainability challenges or market fluctuations, investors can contribute to Ghana’s continued economic growth while realizing profitable returns on their investments.