Investment banks in Ghana

Investment banks in Ghana have witnessed significant growth over the past decade, with several local and international financial institutions establishing a presence in the country. Ghana’s investment banking sector plays a crucial role in facilitating economic development by providing various financial services, including corporate finance advisory, underwriting securities offerings, asset management, and wealth management.

Which is the leading investment bank in Ghana?

Ghana’s investment banking landscape is dominated by both local and international players. Among the leading investment banks in Ghana are:

Barclays Bank Ghana:

As one of the oldest and most established financial institutions in Ghana, Barclays Bank offers a comprehensive range of investment banking services. The bank has a strong presence in corporate finance advisory, capital markets, and wealth management. In 2020, Barclays was named “Best Investment Bank in Ghana” by Global Finance magazine for the fifth consecutive year (Global Finance, 2021).

Standard Chartered Bank Ghana:

Standard Chartered is another significant player in Ghana’s investment banking industry. The bank offers a wide range of services, such as capital markets, corporate finance advising, and asset management. Standard Chartered has participated in several significant transactions in Ghana’s capital markets (Standard Chartered Bank, 2021).

Access Bank:

Access Bank entered the Ghanaian market through its acquisition of Millennium BH International Limited (MBIL) in 2019. The bank offers a broad spectrum of investment banking services such as capital markets, corporate finance advisory, and asset management (Access Bank Plc., 2021).

Guaranty Trust Bank (GTBank):

GTBank is a leading Nigerian financial institution with a growing presence in Ghana. The bank provides investment banking services such as capital markets advisory and corporate finance solutions to clients (Guaranty Trust Bank Plc., 2021).

ECBank:

ECBank is a leading indigenous Ghanaian bank that offers investment banking services including capital markets advisory and corporate finance solutions (ECBank Ltd., 2021).

What is the best investment in Ghana?

The best investment opportunity in Ghana depends on individual risk tolerance and investment objectives. Generally speaking, some promising sectors for investments include:

Agriculture:

With fertile land and favorable climate conditions, agriculture remains an attractive sector for investors seeking long-term returns (World Bank Group, 2021).

Renewable Energy:

Renewable energy offers investors a great chance to capitalize on the rising demand for sustainable energy solutions because of its rich solar and water resources (Ministry of Energy & Petroleum, 2021).

Real Estate:

The real estate sector continues to grow due to increasing urbanization and population growth (JLL., 2021). However, it’s essential to conduct thorough research before investing as property prices can be volatile due to market fluctuations and economic conditions.

Stock Market:

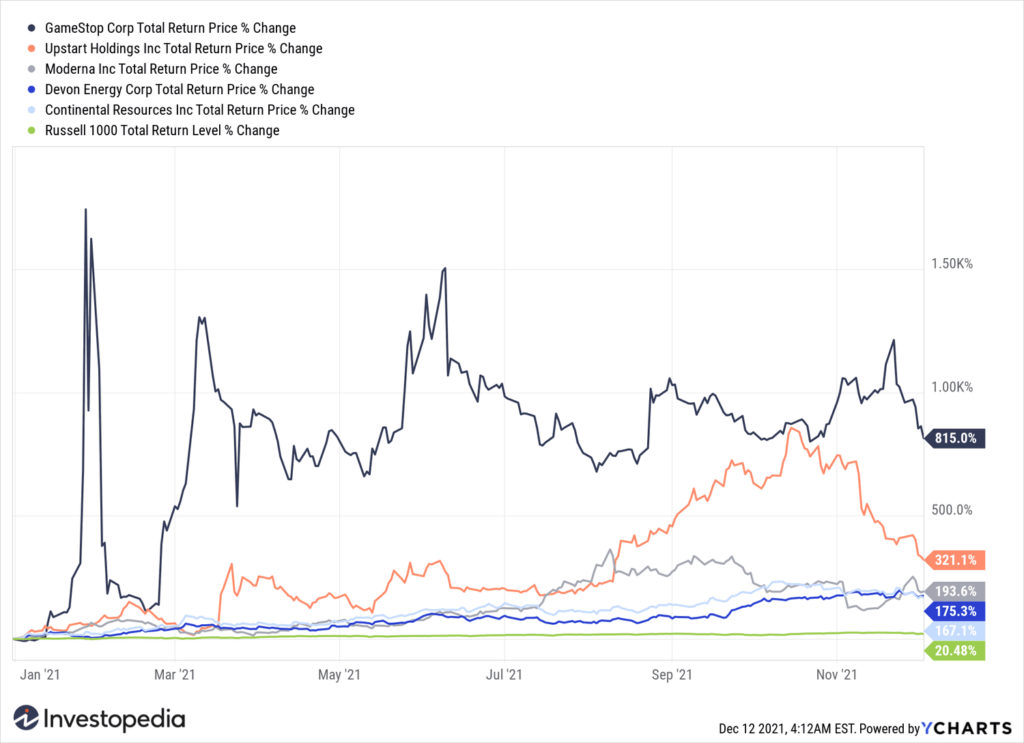

High gains can be obtained from stock market investments, however, there are hazards involved because of market volatility (GSE, 2021). Before making any decisions, prospective investors are advised to consult a specialist.

Mutual Funds:

Through expert fund management, mutual funds minimize risks and provide diverse investment possibilities across several industries (NIC, 2021). However, because mutual funds have their own set of hazards connected to market volatility and fund management fees, investors should carefully examine their degree of risk tolerance before making an investment.

Government Bonds:

Because they carry less risk than other asset types like equities or mutual funds, government bonds are seen as reasonably safe investments (BoG., 2021). In contrast to other assets like stocks or real estate, government bond rates may not give large profits, but they do provide security in an unpredictable economic environment.

What do investment bankers do?

Investment bankers serve as a middleman between businesses in need of funding and individuals eager to make profitable investments. On behalf of their customers, they underwrite securities offerings like stocks or bonds and provide advice on mergers and acquisitions as well as other strategic deals to assist in raising funds (Investopedia, 2021).

Investment bankers typically work long hours and have demanding jobs that require strong analytical skills, excellent communication abilities, and extensive knowledge of financial markets and instruments (CareerOneStop., 2018).

They often work closely with clients across various industries such as healthcare, technology, energy & utilities among others to provide tailored financial solutions based on their unique needs (Investopedia., 2019).

Their primary goal is to help clients raise capital efficiently while ensuring optimal financial outcomes for all parties involved.

investment banks in Ghana reflects a promising landscape amidst economic growth and increasing investor interest. Despite challenges like regulatory frameworks, the sector holds potential for local and international players. Innovation, collaboration, and sustainable practices are key drivers. Investment banks serve as vital agents for economic development, channeling resources to impactful projects. Navigating market complexities and embracing global standards, they contribute significantly to Ghana’s prosperity and regional financial prominence.