Ghana’s Currency Challenges and Developments

Ghana, a country located in West Africa with a population of approximately 34.8 million as of 2018. The country has been facing significant challenges regarding its currency, the Ghanaian cedi. The currency depreciation and its impact on the economy have been a cause for concern among policymakers and citizens alike. Let’s dive directely into this topic of the Ghana’s Currency Challenges and Developments.

Currency Depreciation and Economic Effects

The Ghanaian cedi has experienced notable depreciation against major currencies like the U.S. dollar. For instance, between January and October 2022, the cedi declined by a significant 55%, leading to increased costs for imports. This depreciation has made imports more expensive for Ghanaian businesses, affecting various sectors of the economy.

The effects of currency depreciation have been particularly challenging for importers in Ghana. High costs due to the weakened cedi have made it difficult for importers to sustain their businesses. Restricted access to foreign exchange and delays in trade transactions have further exacerbated the situation, leading to struggles among Ghanaian importers.

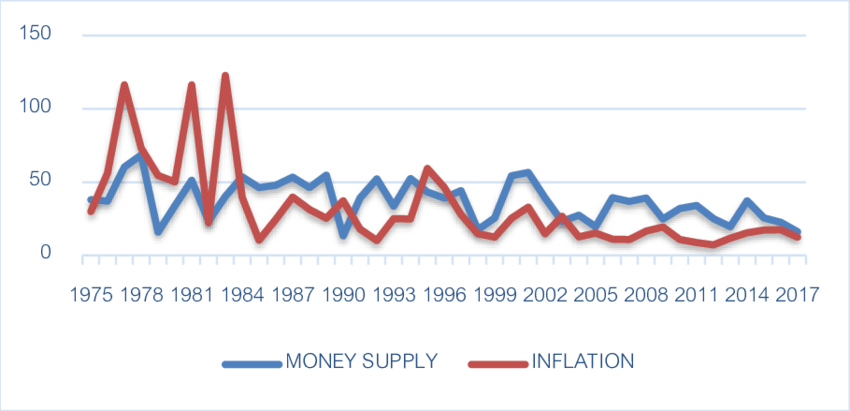

Inflationary Pressures and Consumer Demand

The depreciation of the Ghanaian cedi has contributed to high inflation rates in the country. In October 2022, inflation surged to 40.4%, driven by higher prices of food and fuel. Locally produced goods saw a price increase of 39.1%, while imported products experienced a more significant rise of 43.7%. This inflationary pressure has eroded consumer purchasing power, making essential products less affordable for many Ghanaians.

Various sectors of the economy have been affected by these challenges in consumer demand and inflation rates. Industries such as consumer household goods, cosmetics, oil and gas, agribusiness (including processed foods), and pharmaceuticals have felt the impact of currency depreciation and high inflation rates. Businesses relying on long-term contracts with local clients have faced hesitancy from customers concerned about the financial implications of volatile exchange rates.

Government Response and Policy Measures

To address these economic challenges related to currency depreciation and inflation, the government of Ghana has taken steps to stabilize the situation. The Bank of Ghana has reported delays in foreign exchange distribution, impacting businesses that rely on timely access to forex for their operations.

In November, measures were introduced to support foreign exchange availability for essential imports such as rice, poultry, vegetable oil, fruit juices, toothpicks, pasta, water, and ceramic tiles. A tariff line list was released to guide importers on accessing foreign exchange for these critical products.

Despite these efforts, high inflation rates continue to pose challenges to consumer demand and overall economic stability in Ghana.

Bottom lines

Ghana’s developments, and its currency challenges, particularly regarding the depreciation of the cedi and its impact on inflation rates and consumer demand, remain significant issues for the country’s economy. The government’s response through policy measures aimed at stabilizing foreign exchange availability is crucial in addressing these challenges effectively.